Knowledge Hub

Join the Conversation!

Impartial and independent, ThoughtLeaders4 Private Client Knowledge Hub hosts cutting edge industry content and insight.

Email maddi@thoughtleaders4.com to submit content.

Private Client Magazine - Issue 19 - Offshore Edition

MOVEMENT. STRATEGY. EVOLUTION.

“All mankind is divided into three classes: those that are immovable, those that are movable, and those that move.” - Benjamin Franklin

We are delighted to publish the 2025 Offshore Edition of our Private Client Magazine. This edition reflects a private wealth world in motion. Across offshore structuring, philanthropy, litigation, reputation, and regulation, the contributors explore not only where the ground is shifting, but how forward-thinking advisers and families are responding with agility and intention.

From the waning era of Non-Dom protections and the rise of Jersey Private Funds, to the evolving human role in a trust landscape increasingly influenced by AI, one theme stands out: adaptability.

We meet those who remain immovable, wedded to legacy practices now under scrutiny. We those who are movable, reacting to pressures, be they fiscal, reputational or generational. And we meet those who move, shaping the next chapter in offshore thinking, anticipating change, and driving innovation.

Whether it’s rethinking the use of reserved powers, navigating transatlantic trust challenges for US persons, or introducing arbitration into trust disputes, the authors bring both urgency and clarity to complex, cross-border realities. Even philanthropy, often a feel-good footnote, is approached with rigorous due diligence and structural insight.

Taken together, this issue invites practitioners to ask: where do I - and where do my clients’ sit in Franklin’s taxonomy? And more importantly, what’s the next move?

Read More

Category filter

Topic filter

Community Magazine

Community Videos

Catch-Up with our Chairs before the Private Client Advisory and Litigation Forum in Paris 2024

April 2024

Watch Video

Practical Considerations When Encountering Financial Distress Within Trust Structures

November 2023

Watch Video

TL4 TV | Ajay Wiltshire & Marianne Kafena | Wealth / Life Middle East (DXB)

December 2022

Watch VideoCommunity Articles

Using The Equitable Toolkit: Unravelling Complex Property Arrangements in Passi & Ors v Hansrani

October 2024

Read More

Oppression Mismanagement In Family Owned Companies and Tempering The Unbridled Casting Vote by NCLAT

September 2024

Read More

Security Deposit For Costs in Liechtenstein Civil Proceedings: Not To Underestimate

June 2024

Read More

Presumption of Death: What Do I Do If A Loved One Has Been Missing For A Long Time?

May 2024

Read More

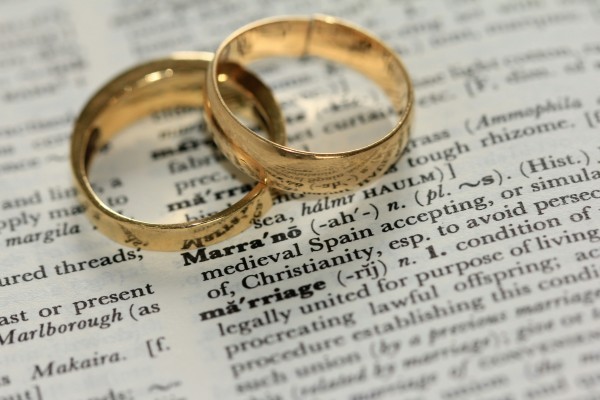

The Law of Unintended Consequences: The ‘Overseas Relationships’ That Are Considered Tantamount To Marriage in England

April 2024

Read More

Our Private Client Corporate Partners

Contact Us

In order to suggest topics or write for our knowledge hub please contact Paul on +44 (0) 20 3398 8510 or email paul@thoughtleaders4.com